Menu

| System | > | Accounts | > | GST | > | GST |

| System | > | Accounts | > | GST | > | GST - Divisional |

If the Division has been set up to have its own GST, select the GST – Divisional menu option. If that menu option is disabled then the Division has already been set up to use the global settings.

Mandatory Prerequisites

Prior to entering the GST Rates, refer to the following Topics:

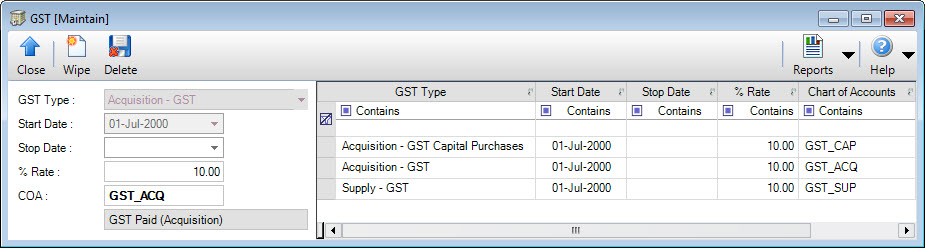

Screenshot and Field Descriptions

GST Type: this is a drop down list of the GST types that can be assigned to Chart of Accounts where GST is applicable.

Start Date: this is the date from which this GST Rate is effective.

Stop Date: this is the date when this GST Rate ends.

% Rate: this is the percentage rate of the GST.

COA: this is the Chart of Account for the GST control account that GST amounts will be recorded against. The GST Type for the COA on the Chart of Accounting maintenance screen must be set as either Supply - GST Account or Acquisition - GST Account.

GST Rates table: this displays the GST Rates already entered.

How Do I : Search For and Maintain Entities

These General Rules are described in the Fundamentals Manual: How Do I : Search For and Maintain Entities

How Do I : Modify an existing GST Rate

GST Rates are associated with the following Topics: